Waste Oil Furnace Tax Advantages Too?

That’s right, there may be a great reason to invest in a waste oil furnace for your business – even beyond the immediate cost savings generated by turning used motor oil into free heat.

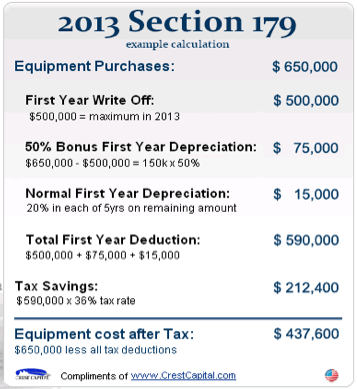

We recommend checking with your accountant to make sure, but Section 179 of the US Tax Code allows businesses to achieve significant tax savings on certain types of purchases. Here’s a screen grab from the IRS website showing a sample calculation of tax savings. Click the image to visit the Section 179 website and learn more.

Now, here’s the disclaimer… we’re not tax accountants, so please check with your CPA to learn how to best take advantage of this deduction. A Clean Energy Heating Systems waste oil heater may qualify as a recycling product under Section 179 regulations, so please have your accountant explore the tax code and decide if this deduction would apply for your business.